Easter Island Moai

Travel Hacking 101

Travel for Free

Business Travel Hacks

Hack your way around the Globe

Best Travel Hacking Credit Cards

The Ultimate Guide to Travel Hacking

Cheapest Business Class to Singapore

These are just some of the headlines you will see on social media.

Starting to Travel Hack can be intimidating. I mean, who wants to keep track of 30 different credit cards? How do you decide which ones? What about my credit score?

And, how exactly do you get started travel hacking?

I’m going to break it down for you and give you some easy steps to start Travel Hacking 101.

Table of Contents

Travel Hacking 101

Flying used to be the primary way to earn points or miles that you could redeem for free tickets. Not anymore.

Many airline loyalty programs (mostly domestic airlines like United, American, Delta) have changed their rewards based on how much you spend. This means the miles you earn depends on how much you paid for the ticket and not the actual miles flown.

Credit Cards are now the best and quickest way to earn enough points to get free or low costs flights. ergo, the rise of travel hacking.

How Does Travel Hacking Work?

You’ve seen the offers and heard the stories about the best travel hacking credit cards. Sign up and receive 100,000 points! You may have even done one only to find out that you couldn’t meet the spend requirement. Or that the points didn’t work for the type of trip you were taking. Or, that you didn’t start early enough.

What is Churning?

Ngorogoro Crater, Tanazania

Churning is a tool for travel hacking. It means that you are opening and closing credit cards to get the most points. Generally, you’ll be signing up for a card that has an annual fee and know the fee will be waived the first year. You meet the spend, get the points and cancel the card right before the next year’s fee is due. Some people do this with up to 30 cards a year. It’s a lot to keep track of. I general carry 3-5 cards and do churning on a much smaller level.

Are there Downside to Churning?

Yes. Credit cards are not free money. You do have to pay them off or incur high penalties and fees. You should only consider churning and travel hacking if you pay off all of your credit card bills monthly. Otherwise, the fees and interest costs more than you gain.

Does Travel Hacking Hurt my Credit Score?

Churning can have an impact on your FICO score. The top FICO score is 850 and an excellent score in anything above 740. You need a good score to get the best credit card deals. This score is based on a number of factors, including:

- Your payment history

- Credit utilization ratio (how much of your total credit are you using)

- Average age of your accounts

- How many accounts you have opened recently

- Your mixture of credit (mortgage, student loan, car loan)

Paying your bills on time is the single most important factor in keeping a good credit score.

Churning can affect the utilization ratio, average age of your accounts and and total number of accounts.

What are Spend Requirements?

Sue and Reggie in the Sahara Desert, Morocco

The bonuses are only credited into your account after you have met the spend requirement of the card. You usually have 90 days to meet the spend. The spend can range from $500 to $25,000.

How do I Start?

Assuming that you have a good credit score, you need a strategy to get started. This travel hacking strategy enables you to track, understand and plan how to accumulate points. It also helps you to figure out the loyalty programs that best suit your travel objectives.

Do you want to accumulate enough points for several domestic flights across the US? Or to Europe?

Do you primarily fly a certain airline? Or do you want flexibility to direct your points to different airlines?

Are you dreading a 20+ hour flight to Asia? Thinking about paying for premium economy or business class?

Check out my post on How I score Cheap Business Class to Singapore

Sue and Reggie on a Glacier in Alaska

Chase Ultimate Rewards (UR), American Express Membership Rewards (MR) and Citi Thank You Points (TY) are some of the programs that can be used to transfer to different airlines and hotels. If you are devoted to a certain airline, then you’ll want to take a look at the credit cards that are connected to your airline. For instance, I have a MileagePlus Explorer card from Chase that gives me United Airlines miles.

Planning is Key

It takes time to accumulate points. We like to look 1-2 years in advance to see what kinds of trips we are planning to make and get the cards that help us get there.

Big expenditures are very helpful for satisfying spend requirements. I recently made the mistake of getting a new credit card right after I have bought tickets for a flight to Asia. Not only did I miss satisfying the spend requirement, but I also missed out on getting 5X points for the flight. Ouch.

Hotel Credit Cards

Hotel credit cards can be useful if you stay in hotels. If you’re the AirBnB type, then not so much.

Hyatt, Hilton, Marriott/SPG, International Hotel Group (IHG of Holiday Inn family of hotels) all have credit card programs with rewards.

Deciding on which of these programs to build your loyalty points with will help you to get started.

You Have Your Strategy. What Now?

So you’ve decided on your travel hacking strategy. Now it’s time to sign up for a credit card.

You can find deals in the mail and online. And, you’re most likely going to have to pay an annual fee. Keep in mind that the annual fee is usually waived for the first year.

There are credit cards without any annual fees – they typically do not have the best offers for signing up so I usually do not pay them much attention. Also, the lower the spend requirement, the smaller the bonus.

There are several cards out there with under $100 annual fees that have good bonuses.

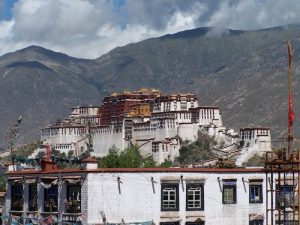

Potala Palace, Tibet

Next Steps in Travel Hacking 101

Sign up for your chosen card. Keep your eye out for a good bonus as they change regularly. Apply as soon as you see one you really like.

Make sure to sign up for the airline’s loyalty programs. Install shopping portals and don’t forget about the hotel loyalty programs.

Finally, be disciplined in following the steps to accumulating points. Charge everything to your credit card. And, pay them off every month. Deciding where you would like to go will also help you figure how many points you need to get started.

Redeeming Points

You have to pay attention to redeeming issues. I recently looked at the Alaska Airline program which is a generous offer. But I live on the east coast and redeeming would have been very challenging.

There can be some tricks that help you to redeem points and maximize availability. For instance, I had difficulty using British Airways Avios points until I figured out that the availability increase dramatically if I planned a short stopover in the UK. British Airways also charges a lot of fees when you fly on BA. The fees on partner airlines are much less.

Sometimes points can be worth much more when redeemed through the program’s travel portal like Citi or Chase.

Best Travel Hacking Credit Cards

Credit card offers change frequently. Some of my current favorite are below. These terms can change for better or worse so make sure to check the existing offer before signing up.

Chase Sapphire Preferred

Chase Sapphire Preferred is offering 50,000 Ultimate Rewards points (Chase UR program) after $4,000 spend within 3 months. You receive 2x points on travel and dining and 1x on other categories. This is the best starter card right now. The card also offers other travel benefits like auto insurance on rental cards.

Citi Thank You Premier Card

The Citi Thank You Premier Card is currently 60,000 points after $4,000 spend within 3 months. You receive 3x points on all travel including gas, 2x on dining and 1x on other charges. You will not receive the bonus if you have previously applied for and closed a Citi product within the last 24 months.

British Airways Visa

BA Visa has a $95 fee and you can earn 50,000 bonus Avios after you spend $3,000 on purchases within the first 3 months. You can earn another 25,000 bonus Avios after you spend $10,000 total within your first year of account opening or a further 25,000 bonus Avios after you spend $20,000 total on purchases within your first year from account opening for a total of 100,000 bonus Avios. You get 3x Avios if you use this card to pay for your BA flights.

Make sure to check what the current offer for these cards are. As I noted above, they change frequently. Keep your eye out for the very best offer.

Sue visited the Penguins in Antartica earlier this year.

Make Sure you Qualify for the Bonus

Travel hacking is very enticing but you need to know the fine print on bonuses. Don’t make the same mistake I did when I applied for the Amex Gold Business card last year, hoping for 60,000 Membership Rewards. After 3 months of making the spend, I found out that I did not qualify for the bonus because I had the same product 5 years earlier.

Some cards have a lifetime limit of only a 1-time bonus (American Express, for example). If you have opened or closed a product recently, you won’t be eligible for the bonus. Chase has a 5/24 rule – this means you can only apply for 5 new Chase credit cards within a 24 month period. This rule does not apply to airline co-branded product.

Have a rough idea of how you will meet the spend requirement. This is especially important if you are opening up several credit cards in a relatively short period (also bear in mind the impact on your credit score).

Reggie and Sue in Machu Pichu

6 Steps to Start Travel Hacking 101

1. There are many credit card products with different loyalty programs and spend requirements. Only you can determine which is the best travel hacking credit cards for you.

2. I prefer applying for non-airline affiliated credit card because it gives me the flexibility to transfer the points to any airline.

3. Charge everything you possibly can to the credit not only to hit your spend requirement but also to build your points.

4. Apply for a credit card before you know you have a large purchase planned, it will help meet your required spend quickly.

5. Once you have met your required spend. Put the card aside. Then look at applying for another card. If this card has the annual fee waived, remember the anniversary date for next year when the fee will be due.

6. Decide on a destination and date of travel. Check the award requirements for the flights. Determine if you have enough points then transfer it to the airline frequent flier program you have found the award on and book your flight. The transfer is typically instantaneous (make sure you link your Frequent Flyer account to your credit card program whether you have decided to build UR or MR points.

You might want to read Travel Tips: 10 Ways to spot Fake Deals and Scams

Please Comment. Do you have some Travel Hacking 101 Tips to Share?

Please Pin and Share

Really informative, and I learned some new vocabulary words like “churning”. This guide was very helpful in navigating what can be an overwhelming process

Thanks. Glad you found it helpful. Love to hear if you decide to try it out.

Thank you for bringing up the credit score issue! I don’t know how many times I’ve shook my head at an article that just says go ahead and open and close credit cards with no consequences!

Yes. Important to go in with your eyes open.

I felt funny reading the post. My last job was in credit card analytics where we were beating our heads on the “gamers” – that’s the term for people game of the cc offers. Travel hackers are the most unprofitable segment for cc companies but it’s not unethical. Your credit score does get affected and also note that many of these cards have a condition that a person can avail the bonus on the first card only (citi), and some even reject the second application of the same card (amex). Looks like it’s time for me to switch sides 😛

Glad to hear from an insider. I think there’s a way to do this as a win-win if neither side overdoes it.

Whoa, this was a super helpful post! Travel hacking and churning have always really intimidated me but the way you broke them down in this post made them seem way more straightforward. I’ve been thinking about getting a new rewards card, I might have to keep my eye out for one of the ones you mentioned.

It can seem intimidating at first. But you can start with one card and see how that goes.

Really interesting! I am no longer as organized as I used to be to track these kind of things. I have trouble with just 2 cards, but maybe some day I can figure out how to concentrate enough to do this hacking procedure.

Thanks, very informative. I have some food for thoughts. Thanks for sharing!

Very informative. I just found out that I really screwed up by booking flights thru Kayak (which had me booking thru another vendor, FLYUS), and have to forfeit a large $ amount in cancellation fees above and beyond what the airline itself charged to cancel a flight. I should have compared on Kayak, and then booked directly with airline. Lesson learned, but I feel so ripped off, and definitely stupid for not being careful enough!

Lauren-Sorry to hear about this. It’s happened to me too. Some lessons learned are very expensive.